Despite what insults you quietly mutter about them around April 15, the Internal Revenue Service (IRS) does support entrepreneurs who apply a little elbow grease to their marketing. The IRS generously provides tax deductions for certain business expenses, such as the cost of printing business cards and other marketing collateral.

IRS BENEFITS

IRS BENEFITS

Small business owners who frequently promote through traditional print ads, like flyers and postcards, should consult Chapter 11 of Publication 535, which qualifies advertising expenses as a tax exemption:

“You generally can deduct reasonable advertising expenses that are directly related to your business activities….You can usually deduct as a business expense the cost of institutional or goodwill advertising to keep your name before the public if it relates to business you reasonably expect to gain in the future.”

DEDUCTIBLE MARKETING EXPENSES

1. Initial Costs

The cost of starting your business can be deducted after you open your doors. Well-documented expenses up to $5,000 (meaning keep close tabs on those receipts) during the development phase can be deducted within the first year of business. This applies to payments necessary for operation, i.e. salaries and employee training as well as marketing and advertising.

2. Ordinary Marketing Expenses

What qualifies as “ordinary” marketing expenses? According to American Express, this means business cards, print ads, web banners, billboard rentals, etc. These can be fully deductible and have no dollar limit, so go ahead and splurge.

Other expenses that do not receive the same special treatment include signage temporarily installed at a trade show or that will be used for over a year. Bummer, isn’t it? But you can write off travel expenses and registration fees if you promoted your business at industry events.

3. Design Costs

Did you hire a graphic designer to create those eye-catching posters? Believe it or not, it pays to design and print marketing materials. Costs associated with building your brand reputation are 100 percent deductible.

4. Direct Mail Marketing

If you allocate your budget for postcard advertising, those dollars and cents are tax exempt. Even postage paid for direct mail marketing or EDDM services are a deductible cost. To claim expenses for printing and postage, report them separately under Other Expenses on your Schedule C.

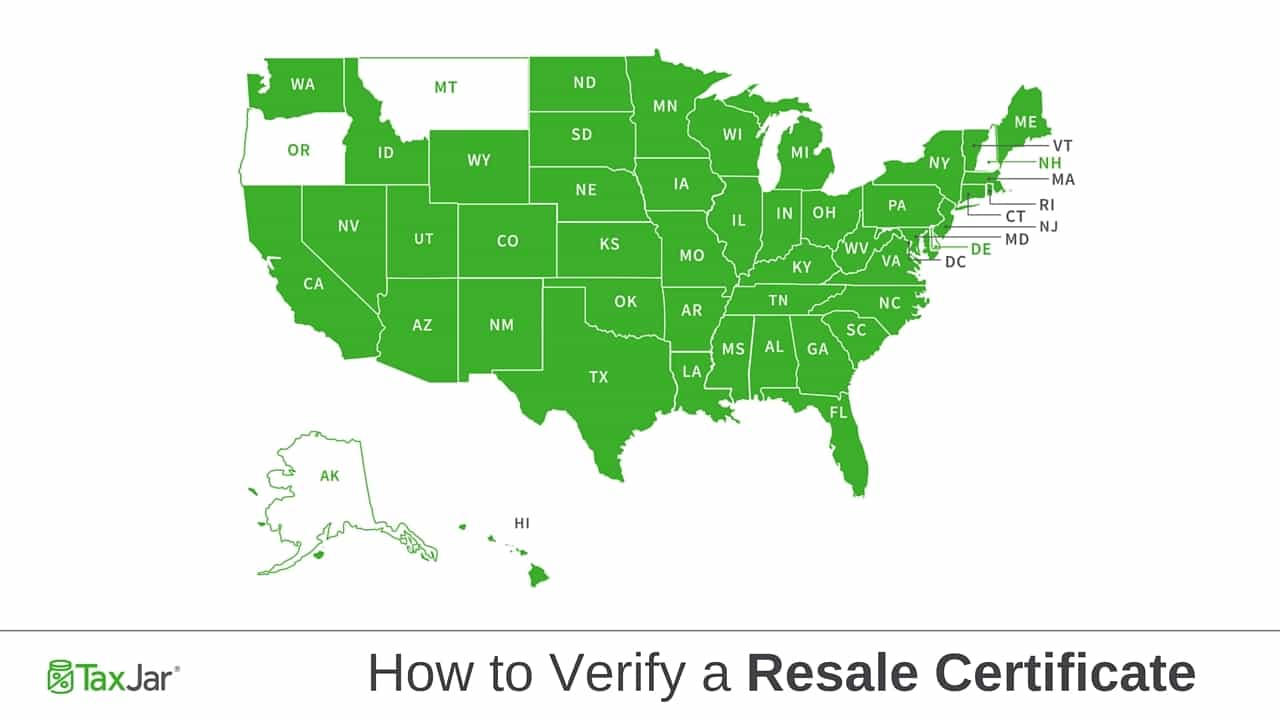

5. Reseller Sales Tax Exemptions

Print resellers, like web-to-print stores, graphic designers and event planners, can catch a break by applying for a resale certificate in their state.

For print providers, do your due diligence and verify resale certificates, so the IRS doesn’t come knocking on your door for any uncollected sales taxes.

Conduct business across the U.S.? “Bear” in mind that some states, like California (get it?), will not accept out-of-state resale certificates. If you plan on crossing state lines for your purchases, consider applying for a multijurisdiction resale certificate.

Consult an accounting or tax professional on how to claim marketing expenses and other deductions for your small business.

Start printing your tax-deductible marketing materials at OvernightPrints.com today.